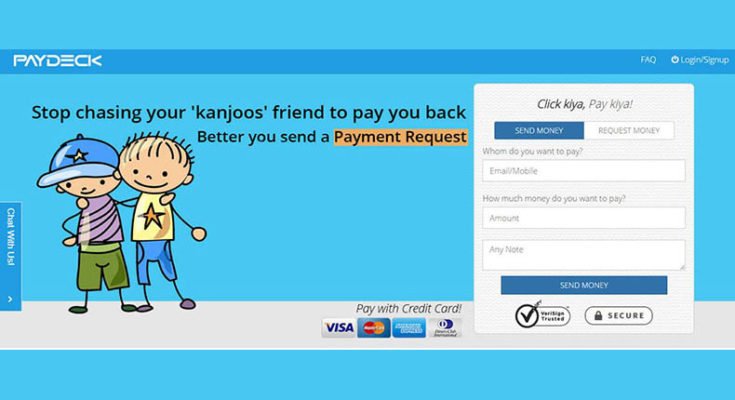

My E-wallet experience Vs My Startup PayDeck™. Image Courtesy – www.paydeck.in.

Paypal has been the most successful FinTech company so far and it was only a matter of time before budding start-ups in India provided a similar solution. In order to create a drive for Cashless economy, many companies in India started with a fin-tech module, which has been doing great for last decade in USA – that is E-wallets!

I must say it’s great to hear the advertisement of real time payments happening, cashless! And rather than worrying for small payments & coin’s for paying to our taxi, auto or even Panwala, we have the option to use these E-Wallets! Great Service & initiative. Congratulations!

I myself am a user of these E-Wallets and have been using them for easy payments for taxis, movie tickets & recharges. And my reason to use it has been that my debit/credit card is stored there on these e-wallets & I can simply put CVV & OTP & the payment is done. I don’t need to remember my Card Number, nor my consumer no. for Internet payments. And I just love using e-wallets for this ease of making small INR100-1000 payments.

However, when it comes to making larger payments, like paying to my friend INR 10k – 15k, or paying my monthly rental or my society maintenance or my child’s education fees, I fail to use these E-wallet services. A number of these places do not accept cards either and make it quite inconvenient.

Read: Fitbit got the top position with 29.5% market share

In India, we need real & point-to-point payments, which let you send and receive money from where it usually resides. There are many e-wallets but you don’t receive the payment in your bank account directly, if someone pays for a service or a friend pays you personal payment!!

About a year back, I was trying out an e-wallet service to pay my friend Rs. 15k. First of all, I was stopped stating that I need to verify my KYC for making large Payments, as RBI’s Wallets Regulations stops them to make any kind of payment, above their sanction limits. So, I decided to lower the amount to INR 4K.

I was given two options – to Bank or to Mobile. I chose to do this experiment with both options. So I sent payment of INR 2K to his mobile number and INR 2k towards his bank account. To my surprise, when I send the 2k to the mobile number, the money went quickly to my friend’s e-wallet & he was able to use the entire sum within the e-wallet’s eco-system. However, the money that was sent to his bank account had a charge of more than 4% and took time to reach.

As per my understanding, card swiping cost in India is about 2-2.5% and taking money out of your Bank account is more or less free. Then how come a withdrawal charge from own e-wallet account, which claims 100% free service to use in all advertisements, charges more than 4% for bank withdrawal? Later, I also found out that the registered merchants actually bear the charges for e-wallet’s facilities and pay close to 3%; basically the merchants seem to be subsidizing the P2P transfers!!

Read: 6 tips to become successful real estate agent

With my little experiment and discussions with resourceful friends I concluded that:

E-wallets are definitely a good thing till you keep your card stored with them and use them to make small payments within the specific wallet’s eco system. You are being subsidized by the Merchants who seem to be happy to do that!

E-wallets are convenient if you are happy to lose interest on your own money by keeping the money on the e-wallet. If you are going to ‘charge’ your wallet every time you make a payment then the convenience factor is largely lost. So convenience comes at a cost.

Wallet also works well when you want to make small payments within the specific wallet’s ecosystem. If you want to send money to a universally acceptable platform then the cost is exorbitant!

E-wallets don’t work when you have to make large payments such as your home rentals, society maintenance bills, child school or tuition fees, interior decorator’s bill, club charges, etc.

Lastly, payments from wallet “A” to wallet “B” are not possible and unlikely to be cheaply available in the near future. Basically, you need to install multiple wallets to be able to quickly make payments to merchants and/or friends, else you are forced to download a specific wallet using your 3G data – that has its own complications and I need to write a separate article to cover that, but you get the drift!

Well, a year has passed since that experiment and not much has changed in the e-wallet space except that there are a lot more options and a lot more wallet to download and keep.

Read: 30 Reasons for having your Own Business

Anyways that was the background, which led me to launch my own start-up to an aim to provide a convenient, flexible and simple option for consumers to make payments, I would like to confirm that there’s no rocket science behind PayDeck and we’d like to keep it that way. The basic idea was to create an interface that can really help users who want to make a transaction more than 1k, 10k, 20k or even 100k.

When I started PayDeck, my financial situation was a bit down. My 11-year-old, successful running, web development company was looking at hard times & due to various issues, our payments were stuck. I wanted to use my Credit Card to pay for my society maintenance bills, my friend’s loan & even my rental payment. When I looked around, I couldn’t find a single way to use my credit card for the same. There were of course some, well… how can I say – “not above board” ways to use credit card & pay for stuff but that’s not something I can do. Hence, PayDeck is Initially targeted at those who want to swipe their Credit Card for almost all payments and want to leverage the power of credit cards. Over time, a much wider variety of options would be available and that would make life simpler for ALL.

With PayDeck, you can make direct payments to your landlord, your friend, your society, your child’s school, your child’s tuition teacher, your kiranawala, your food deliverywala etc. No one is required to be disturbed or forced to join PayDeck to receive the payment. All you need is their Bank Account No. & IFSC and your payments are done with a notification being sent to their e-mail ID or mobile number.

As said above, there’s no Rocket Science involved and we haven’t done something that others couldn’t do. We have done it though and done it with the intent of providing a convenient & flexible solution to solve a very real pain point of consumers. A real need and a real situation, where you want to use the power of credit cards to ‘swipe’ & pay! We don’t claim to be better than others but we are the ONLY ONE in India who is providing such a facility to its users.

You don’t need to subscribe with us. You don’t need to take any membership. You don’t need to park your money with us. Neither does the merchant receiving the payment need to be registered with us. When you want to pay, just click and pay to anybody’s Bank Account!

If you don’t know their account number, don’t worry. We also provide the option to pay on their Mobile No. or e-mail ID. There are NO withdrawal charges or hidden charges. Well, we do have to keep the shop running so there of course are charges but they are made known at the onset with a choice as to who bears them – sender or receiver.

Hope to make a difference and make life simpler for all.

Just give it a try & let us have your feedback. It will help us enhance the product to perfection.

Pretty section of content. I just stumbled upon your blog

and in accession capital to assert that I get in fact enjoyed

account your blog posts. Any way I will be subscribing

to your augment and even I achievement you access consistently rapidly.